child tax credit deposit date november 2021

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day.

California P Ebt Reload Update For 2021 2022 California Food Stamps Help

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000.

. 1201 ET Oct 20 2021. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Families will receive 3600 for each child under the age of 6 while.

For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. Get the up-to-date data and facts from USAFacts a nonpartisan source. Half of the money will come as six monthly payments and half as a 2021 tax credit.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 15 is also the date the next monthly child tax credit payment will be sent out. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax.

Here are the official dates. 15 with a deadline of Nov. Under the expanded credit low- and middle-income parents can expect to receive.

In previous years 17-year-olds werent. You will not receive a monthly payment if your total benefit amount for the year is less than 240. That drops to 3000 for each child ages six through 17.

THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next. CBS Baltimore -- The Internal Revenue Service IRS sent out the fifth round advance Child Tax Credit payments on. Wait 10 working days from the payment date to contact us.

November 12 2021 1126 AM CBS Chicago. 947 ET Oct 21 2021. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November.

Families who are eligible but havent signed up could receive the amount of all the advance payments as one lump sum if they opt-in for the final payment of 2021 before the deadline date. Alberta child and family benefit ACFB All payment dates. For 2021 a legal dependent who is age 17 or younger as of December 31 2021 can qualify for the child tax credit.

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. 445 PM MST November 12 2021 The November installment of the advance child tax credit payment is set to start hitting bank accounts via direct deposit and. Low-income families who are not getting payments and have not filed a tax return can still get one but they.

Families who sign up may receive half of their total 2021. The majority of the payments worth up to 300 per child will be issued by direct deposit. The Child Tax Credit has been expanded from 2000 per child annually up to as much as 3600 per child.

29 to make changes for. 15 opt out by Aug. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Those who have already signed up will receive their payments after they are issued. Half of the total is being paid as.

13 opt out by Aug. November 15 2021 542 PM CBS New York. The final payment for 2021 will be Dec.

Most parents automatically get the enhanced credit of up to 300 for each child up to age 6 and 250 for each one ages 6 through 17. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Ad Discover trends and view interactive analysis of child care and early education in the US.

If you are not already receiving Advance Child Tax Credit payments the deadline to sign up is November 15 2021. For both age groups the rest of the payment will come with your. You can get the most up-to-date info about the 2021 Advance Child Tax Credit.

The monthly child tax credit payments which began in July are set to end in December. The IRS is scheduled to send the final. IR-2021-222 November 12 2021.

The IRS is paying 3600 total per child to parents of children up to five years of age. The payments will be made either by direct deposit or by paper check depending on what. But many parents want to.

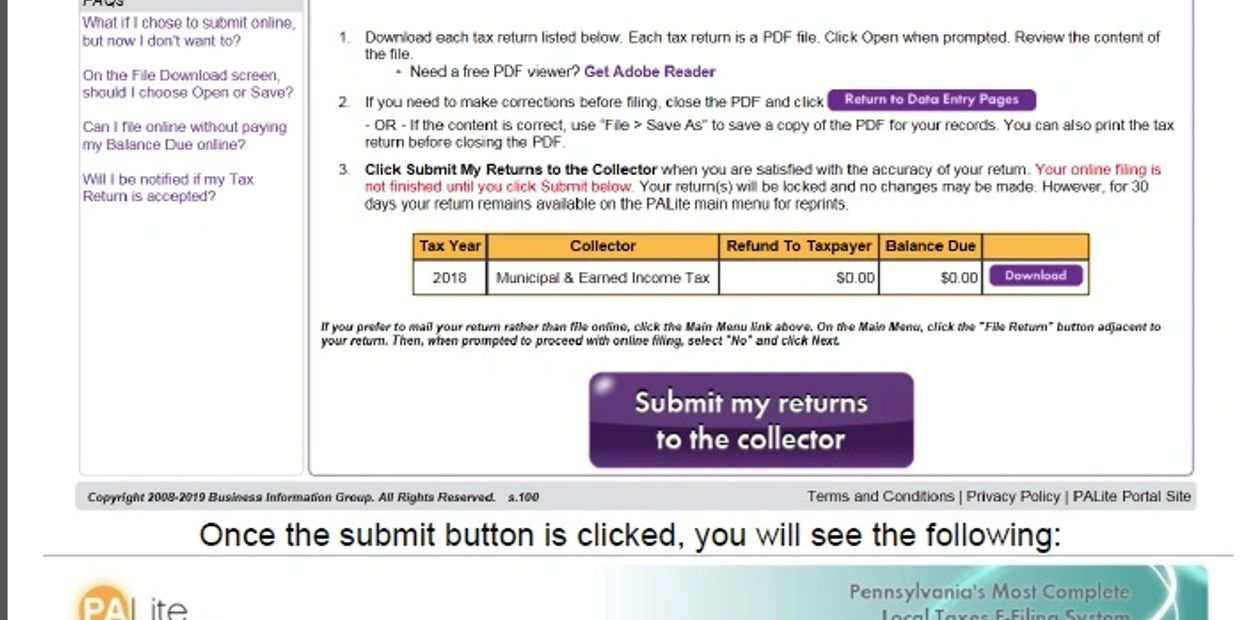

Municipal And School Earned Income Tax Office

California P Ebt Reload Update For 2021 2022 California Food Stamps Help

Average Tax Refund Up 11 In 2021

Childctc The Child Tax Credit The White House

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

Tax Year 2022 Calculator Estimate Your Refund And Taxes

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Pandemic Electronic Benefit Transfer P Ebt Program Maryland Department Of Human Services

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Childctc The Child Tax Credit The White House

3 10 72 Receiving Extracting And Sorting Internal Revenue Service